Any investment in a CD or a lump sum payment made to life insurance company that promises to make a series of equal payments later for some period of time. For example a fixed annuity might pay a 4 percent interest rate for 10 years after which the contract matures and payments cease.

Annuity Contracts For Investment Or For Creating Income Stream

Fixed and Variable Annuities.

. May 21 2019. Pensions are examples of real-world annuities where we make a series of payments at regular intervals. 3 Things to Know About Saving for Retirement.

When their market value changes the amount of money payable to you now represents a different percentage of the market price. Which of the following are examples of real world annuities preferred stock dividends pensions common stock dividends mortgages. Which of the following Excel functions will result in the correct answer for the following annuity problem.

When you want to start receiving payments and how you would like your annuity to grow. Carl receives 28800 for social security an additional 1100year for a pension. 100 once every 2 years.

Carl receives 28800 for social security an additional 1100year for a pension. Which of the following is an example of an annuity. Common stock dividends C.

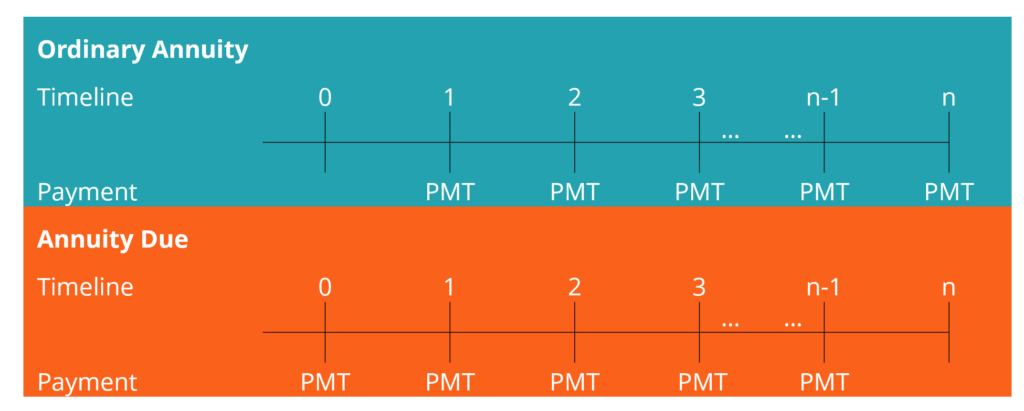

An ordinary annuity consists of a _____ stream of cash flows for a fixed period of time. An annuity with payments beginning immediately rather than at the end of the period is called an ____ annuity due. Suzy has approximately 200k in her 401k and earns 65k annual income.

Which of the following are real-world examples of annuities. O The first cash flow of an ordinary annuity is made on the first day of the agreement. When you begin receiving payments.

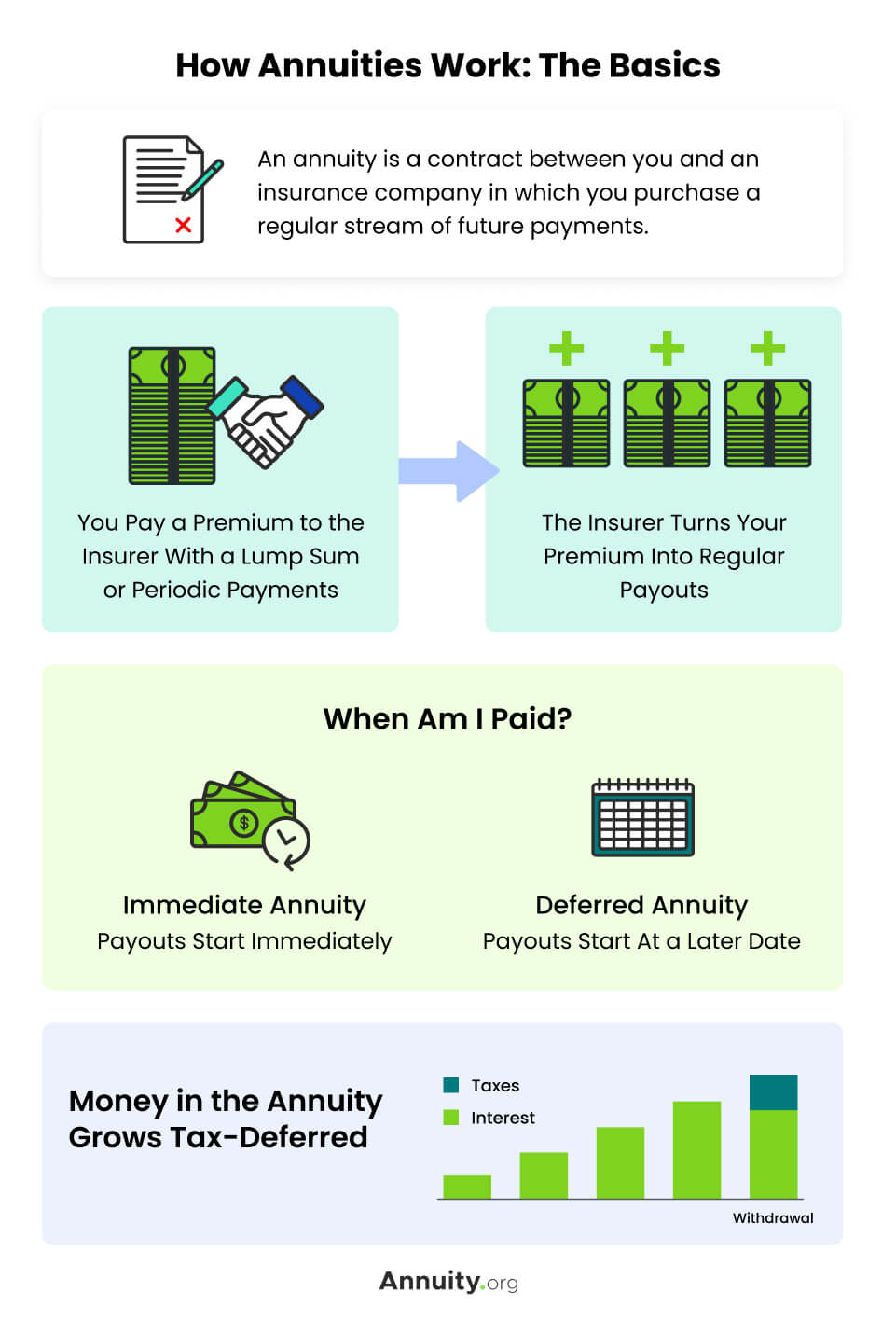

Annuities are insurance contracts that promise to pay you regular income immediately or in the future. The future value of an annuity due of 100 per year for 10 years at 10 per year is. Many decisions and accounting measurements will be based on a reciprocal concept known as present value.

You plan to deposit 100 per year for the next 10 years in an account paying 8. Another important feature of the variable annuity is the family protection or death benefit that often comes along with such contracts. How much will you have in this annuity.

Which of the following are real-world examples of annuities. Accounting questions and answers. Suzy has approximately 200k in her 401k and earns 65k annual income.

This guarantees that should the investor die during the. Currently Carl has approximately 300000 in a 401k from his previous employer. The formula for the _ Present_ __ value interest factor of an annuity is 1-11rtr.

Assume an 100 investment earns a stated interest rate of 10 percent compounded. Which of the following are examples of annuities. O The last cash flow of an annuity due is made on the day.

65-year-old Carl is retired. These four types are based on two primary factors. How much is 100 worth t 10 IR at the end of each year forever worth today.

Two very common examples of ordinary annuities are interest payments from bonds and. A Variable Annuity is a personal retirement account in which the investment grows tax-deferred until the investor is ready to withdraw the assets. 55-year-old Suzy is still working but plans to retire in 10 years.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Immediate fixed immediate variable deferred fixed and deferred variable annuities. Best Age to Get an Annuity.

Which of the following are real-world examples of annuities. When we retire we usually receive a fixed amount of income which is based on a mathematical annuity calculation from the contributions that we have made in the past years. Who are the experts.

Other contracts might specify payments for the life of the contract holder. Leases pensions and mortgages. 55-year-old Suzy is still working but plans to retire in 10 years.

Difference Between IRA and an Annuity. A deferred annuity has an accumulation phase followed by a disbursement. There are four basic types of annuities to meet your needs.

The 4 types of annuities. Check all that apply Car payments Note payable with interest and principal due in 3 months The present value of 1 received 3 years from today Mortgage payments. Currently Carl has approximately 300000 in a 401k from his previous employer.

65-year-old Carl is retired. Select all that apply Check All That Apply o The first cash flow of an annuity due is made on the first day of the agreement. Example of infrequent annuity.

The effective annual rate EAR takes into account the _____ of interest that occurs within a year. These payments could be monthly quarterly yearly depending on the agreement of both parties. Which of the following are real world examples of annuities i.

Knowledge Check 01 Which of the following statements about annuities are true. A fixed annuity pays out a specific return for a specific time period.

How Annuities Work Examples By Type Considerations

Present Value Of An Annuity How To Calculate Examples

Annuity Contracts For Investment Or For Creating Income Stream Annuity Accounting Education Accounting Principles

0 Comments